Introduction: Retirement is a Journey, Not a Destination

Retirement may seem like a distant dream to some and a looming reality for others. Yet, regardless of age, everyone shares one common goal — to retire rich and stress-free. But what does it really mean to “retire rich”? It’s not just about having crores in your bank account. It’s about having enough wealth to live your desired lifestyle without financial worries, doing what you love, and not depending on anyone.

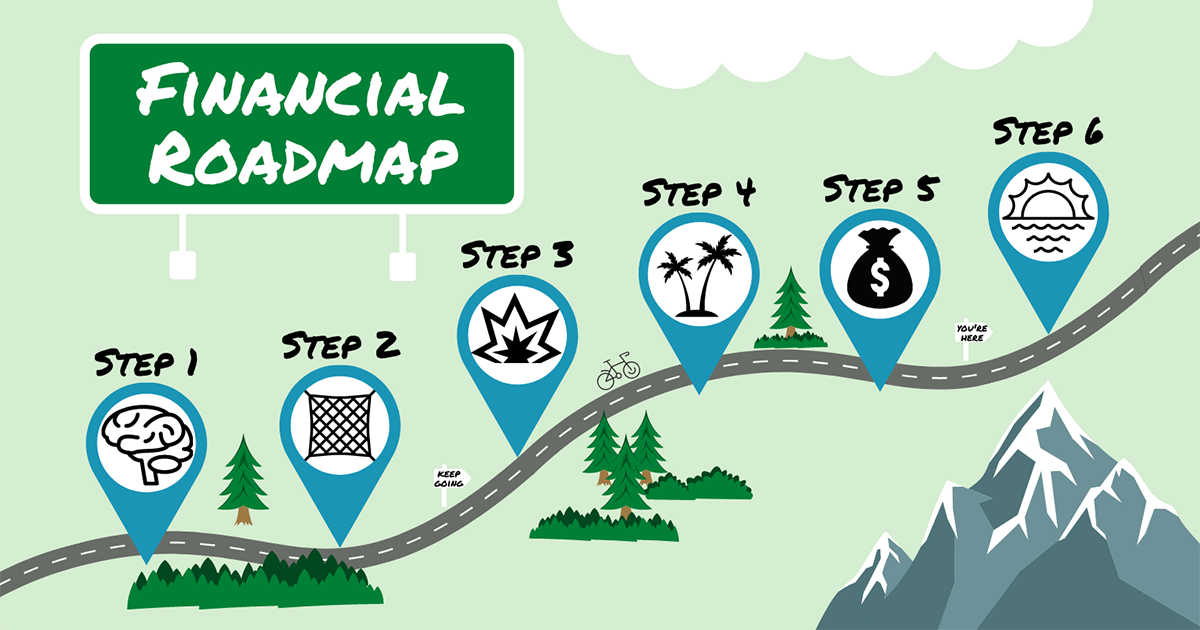

Unfortunately, many people approach retirement planning too late, and with little strategy. The truth is, retiring rich is a matter of planning smart and starting early. It doesn’t require a massive income, just consistent habits, intelligent investments, and a clear roadmap. This article presents a practical, step-by-step guide to help you secure financial freedom by the time you retire.

1. Define What “Retiring Rich” Means to You

Before you begin planning, get specific about your retirement vision. Ask yourself:

- Where do I want to live post-retirement?

- What kind of lifestyle do I want?

- Will I travel, volunteer, start a hobby business?

- Do I want to support my children or grandchildren financially?

Once you have a vision, you can begin calculating how much money you’ll actually need.

2. Calculate Your Retirement Corpus

A retirement corpus is the total amount you need saved by the time you stop working. Here’s a simple method:

Step-by-Step Estimate:

- Estimate your monthly expenses at retirement (adjusted for inflation).

- Multiply that by 12 months × number of years you expect to live post-retirement (typically 20–30 years).

- Add in large one-time expenses (healthcare, travel, home upgrades).

- Subtract any pensions or expected passive income.

For example:

- If you need ₹50,000/month today, and you retire in 20 years, factoring 6% inflation — you’ll need approx ₹1.6 lakh/month in retirement.

- Over 25 years of retirement, that’s around ₹4–5 crore corpus needed.

3. Start Early — The Power of Compounding

Starting early is the golden rule of retiring rich. Thanks to compounding, even small amounts grow significantly over time.

Consider this:

- Saving ₹5,000/month starting at age 25 = ₹2.5 crore+ by age 60

- The same amount starting at age 35 = only ₹1 crore

- At 45 = barely ₹40–50 lakh

The earlier you begin, the less you need to save monthly. Time is your biggest financial ally.

4. Create a Retirement Investment Portfolio

Relying only on savings is a mistake. Your money must grow faster than inflation. A well-balanced retirement portfolio usually includes:

a) Equity Mutual Funds (via SIPs)

- Great for long-term growth

- Beat inflation

- Ideal for young and middle-aged investors

b) Public Provident Fund (PPF)

- Tax-free returns

- Government-backed safety

- Great for conservative savers

c) National Pension Scheme (NPS)

- Ideal retirement tool with tax benefits

- Offers market-linked returns

- Provides annuity after retirement

d) EPF (Employee Provident Fund)

- Mandatory for salaried employees

- Good long-term retirement fund

- Part of your monthly salary contribution

e) Real Estate (Optional)

- Consider one self-use property

- Avoid over-investment in illiquid assets

f) Gold (10–15% for diversification)

- Hedge against inflation and currency risk

5. Increase Your Investment Over Time

A mistake many people make is sticking to the same SIP amount for years. As your income grows, so should your investment.

- Increase SIPs annually by 10–15%

- Redirect bonuses, gifts, or windfalls into retirement funds

- Avoid lifestyle inflation (upgrading phones, cars, etc.) — invest the difference

This habit accelerates wealth creation without compromising your current lifestyle.

6. Protect Your Wealth with Insurance

Growing your wealth is one part. Protecting it is equally important.

a) Term Life Insurance

- Inexpensive and essential

- Choose coverage = 15–20× annual income

- Ends at retirement age

b) Health Insurance

- Buy a policy early while premiums are low

- Ensure coverage for major illnesses

c) Critical Illness & Accident Covers

- Helps during serious health events

- Prevents dipping into your retirement savings

7. Avoid Retirement-Killing Mistakes

Many people sabotage their retirement dreams due to poor decisions. Watch out for:

- Withdrawing PF/PPF prematurely

- Taking personal loans for luxury spending

- Investing blindly in stock tips or risky crypto

- Not accounting for inflation in long-term planning

- Ignoring rising healthcare costs

One wrong step can cost you lakhs, even crores, in the long run.

8. Create Passive Income Streams

To truly retire rich, you need income even after retirement. This ensures that your corpus lasts longer, and gives you financial independence.

Ideas for Passive Income:

- Dividend-paying stocks

- Rental income from property

- Part-time consulting or freelancing

- Publishing a course, book, or blog

- Systematic Withdrawal Plans (SWP) from mutual funds

The goal is to build assets today that pay you tomorrow.

9. Review and Rebalance Every Year

Financial planning isn’t a “set it and forget it” job. Review your retirement plan at least once a year:

- Are your goals on track?

- Are you investing enough?

- Has your income increased? Increase SIPs.

- Market too volatile? Rebalance asset allocation.

Also, review your nominees, will, and insurance coverage every few years.

10. Design a Retirement Lifestyle

Retiring rich also means retiring with purpose. Begin designing your ideal retired life now:

- What will your daily routine look like?

- Will you travel, volunteer, or start a small business?

- Do you want to relocate or downsize?

A clear retirement lifestyle will help you set accurate financial targets — and gives you a personal reason to stay disciplined.

Conclusion: Your Roadmap to a Rich Retirement Starts Today

Retirement planning may seem complicated, but the roadmap is simple:

- Start early

- Save consistently

- Invest wisely

- Protect your wealth

- Avoid major money mistakes

- Let time and discipline do their magic

Retiring rich isn’t just for the lucky — it’s for the planned and prepared. Whether you’re in your 20s, 30s, or even 40s, there’s still time to build a secure, abundant future. The earlier you begin, the more power you give your money to grow.

The best day to start planning was yesterday. The second-best day is today.

So take charge, commit to the process, and pave the way for a retirement that’s not just comfortable, but truly rich — in wealth, health, and freedom.